Hi All,

What is coming from your water tap? What does your water bill pay for?

Water may start out clean at the filtering station, but by the time it travels the miles of pipes to your glass of water or your bathing water, what is the quality? The same as it left the filtering station? Ask Flint residents. Was your household tap tested or did you just get the "official" letter of water quality from your government? Flint residents trusted the government. So, think about it? What is the condition of the water pipes leading into your home? Should you have it tested? Can you trust your local government to maintain the infrastructure?

Bloomfield Township taxpayers have been receiving higher and higher bills for water and sewer each year. Yet in a controversial 5-2 vote in late 2015, Bloomfield Township Board of Trustees transferred $2.76 million of the fees collected from the citizens water/sewer bills and deposited those millions into a Retired Employees Health Care Trust.

Whoa! Is that an illegal tax collected? What about the 1978 Headlee Amendment? Supervisor Savoie claims the money charged from 2009-2015 on the water and sewer bills is a "fee". Some other communities however have been sued and certain "claimed fees" on their water bills were refunded to the taxpayers.

Maybe Bloomfield Township taxpayers should file a class action lawsuit to get back their money. Taxpayers believed they were paying for water and sewer and maintenance/infrastructure needs when they paid their bills.

What is your local government charging you? Taxes or fees? Are you paying for pensions or clean water?

Marcia Robovitsky lives in and writes about what's happening in Bloomfield Township, particularly about the township board and government.

Saturday, January 30, 2016

Friday, January 29, 2016

W&S -user fee or tax ? and Retiree Fund Issues

Hi All,

Monday, January 25, 2016 Board of Trustees @ 7 pm Bloomfield Township, MI

This meeting has another agenda item concerning the W&S transfer of funds into the Retired Employees Health Care Trust Fund. This time the agenda item is to amend the trust language again by adding 2 more trustees.

Even though there was an informal agreement to hold a study session in January 2016 to discuss this Fund, it appears that some on the Board have already met and made a plan. Someone has already made the language changes they want to the document/ presented that to the township/ got it approved to be part of this board packet/ and has already decided who should be the other two proposed trustees of the trust fund. Dan Devine is the Fiduciary Trustee of this fund at present. Was this the work of Attorney William Hampton? Who authorized or suggested the wording to be changed? Savoie? Board members? Would any discussion at the meeting make any difference to the outcome?

Nothing like open and transparent government. This is typical of this administration. It must end.

The vote will probably be 5-2 to approve. It should be 0 yes 7 no. The Savoie administration has changed this Fund where it is now segregating water and sewer employees from all other employees, collecting water and sewer fees to fund it. If this agenda passes at the Monday meeting, the "leadership" will compound the issue with 2 more people acting as Trustee of the Trust and more costs to the taxpayer and less money in the Fund for the retirees.

What I want to say is this: There is no need to add two more trustees to this fund. This is another personal decision and action by a group of people to continue their mission to "take out" Dan Devine.

This agenda proposal should be voted NO. No additional trustees should be or need to be added to this Fund.

My opinion.

Marcia

PS: view the audio/video of Board of Trustees Meetings

Here is an article from 1999.

Monday, January 25, 2016 Board of Trustees @ 7 pm Bloomfield Township, MI

This meeting has another agenda item concerning the W&S transfer of funds into the Retired Employees Health Care Trust Fund. This time the agenda item is to amend the trust language again by adding 2 more trustees.

Even though there was an informal agreement to hold a study session in January 2016 to discuss this Fund, it appears that some on the Board have already met and made a plan. Someone has already made the language changes they want to the document/ presented that to the township/ got it approved to be part of this board packet/ and has already decided who should be the other two proposed trustees of the trust fund. Dan Devine is the Fiduciary Trustee of this fund at present. Was this the work of Attorney William Hampton? Who authorized or suggested the wording to be changed? Savoie? Board members? Would any discussion at the meeting make any difference to the outcome?

Nothing like open and transparent government. This is typical of this administration. It must end.

The vote will probably be 5-2 to approve. It should be 0 yes 7 no. The Savoie administration has changed this Fund where it is now segregating water and sewer employees from all other employees, collecting water and sewer fees to fund it. If this agenda passes at the Monday meeting, the "leadership" will compound the issue with 2 more people acting as Trustee of the Trust and more costs to the taxpayer and less money in the Fund for the retirees.

What I want to say is this: There is no need to add two more trustees to this fund. This is another personal decision and action by a group of people to continue their mission to "take out" Dan Devine.

This agenda proposal should be voted NO. No additional trustees should be or need to be added to this Fund.

My opinion.

Marcia

PS: view the audio/video of Board of Trustees Meetings

Here is an article from 1999.

By Lawrence W. Reed, published on April 5, 1999

In

a recent decision, the Michigan Supreme Court presented a ringing

defense of the 1978 Headlee Amendment to the state Constitution and an

eloquent affirmation of sound economic principles. The decision

established an important precedent that puts municipalities on notice

that the voters who approved the amendment intended for it to be

enforced, not subverted.

Among the several provisions of Headlee is Article IX, Section 31 of the Constitution, which requires voter approval before a tax can be imposed or increased. In its 1994 report, the Headlee Amendment Blue Ribbon Commission found that a growing number of Michigan townships, counties, and cities were skirting the voter approval requirement by mislabeling certain taxes as "user fees." The Michigan Supreme Court’s decision may end that practice once and for all.

In 1995, the city of Lansing adopted Ordinance 925, known by many as the "rain tax." It provided for the creation of a storm water enterprise fund "to help defray the cost of the administration, operation, maintenance, and construction" of a new storm water system that would separate sanitary and storm sewers. Heavy rains had occasionally caused the city’s combined sanitary and storm sewer system to overflow, discharging untreated and partially treated sewage into the Grand and Red Cedar Rivers.

Half of the 30-year, $176 million cost of the system was to be financed through an annual "storm water service charge" imposed on each parcel of property in the city. The city maintained that the service charge was a user fee and therefore did not have to be put before the voters for approval.

But Lansing citizen Alexander Bolt had read the state constitution and knew a tax when he saw one. Bolt challenged the Lansing "rain tax," taking the case all the way to the Michigan Supreme Court, a majority of which on December 28, 1998, declared, "We hold that the storm water service charge is a tax, for which approval is required by a vote of the people. Because Lansing did not submit Ordinance 925 to a vote of the people as required by the Headlee Amendment, the storm water service charge is unconstitutional and, therefore, null and void."

The Court’s majority opinion refreshingly argues that "a primary rule in interpreting a constitutional provision . . . is the rule of ‘common understanding.’" In other words, in this case the intent of the voters should be of utmost importance, as opposed to some judicially activist fabrication. The Court affirmed that the voters intended to place limits on taxes and governmental expansion.

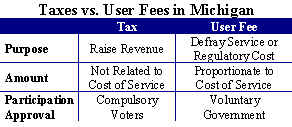

Just what exactly distinguishes a user fee from a tax? The Court advanced three main criteria: 1) a user fee is designed to defray the costs of a regulatory activity (or government service), while a tax is designed to raise general revenue; 2) a true user fee must be proportionate to the necessary costs of the service, whereas a tax may not be; and 3) a user fee is voluntary whereas a tax is not.

The Lansing ordinance failed all three tests of a user fee. The Court determined that it constituted "an investment in infrastructure as opposed to a fee designed simply to defray the costs of a regulatory activity" and agreed with the dissenting opinion in a lower court ruling that the revenue from the charge was "clearly in excess of the direct and indirect costs of actually using the storm water system." The Lansing rain tax applied "to all property owners, rather than only to those who actually benefit," contrary to a genuine user fee.

Most plainly, the rain tax was utterly involuntary. True user fees are only compulsory for those who choose to use a service, but Lansing property owners in this case had "no choice whether to use the service" and were "unable to control the extent to which the service" was used.

The Court’s majority concluded by quoting the Headlee commission report, "This is precisely the sort of abuse from which the Headlee Amendment was intended to protect taxpayers." Amen!

The message is clear to Michigan municipalities: You now have no legitimate excuses for mislabeling taxes as "user fees." Be honest. If it’s a tax, put it before the voters as the Headlee Amendment requires, and make your best case. You can’t ignore the Constitution just because you need the money.

Among the several provisions of Headlee is Article IX, Section 31 of the Constitution, which requires voter approval before a tax can be imposed or increased. In its 1994 report, the Headlee Amendment Blue Ribbon Commission found that a growing number of Michigan townships, counties, and cities were skirting the voter approval requirement by mislabeling certain taxes as "user fees." The Michigan Supreme Court’s decision may end that practice once and for all.

In 1995, the city of Lansing adopted Ordinance 925, known by many as the "rain tax." It provided for the creation of a storm water enterprise fund "to help defray the cost of the administration, operation, maintenance, and construction" of a new storm water system that would separate sanitary and storm sewers. Heavy rains had occasionally caused the city’s combined sanitary and storm sewer system to overflow, discharging untreated and partially treated sewage into the Grand and Red Cedar Rivers.

Half of the 30-year, $176 million cost of the system was to be financed through an annual "storm water service charge" imposed on each parcel of property in the city. The city maintained that the service charge was a user fee and therefore did not have to be put before the voters for approval.

But Lansing citizen Alexander Bolt had read the state constitution and knew a tax when he saw one. Bolt challenged the Lansing "rain tax," taking the case all the way to the Michigan Supreme Court, a majority of which on December 28, 1998, declared, "We hold that the storm water service charge is a tax, for which approval is required by a vote of the people. Because Lansing did not submit Ordinance 925 to a vote of the people as required by the Headlee Amendment, the storm water service charge is unconstitutional and, therefore, null and void."

The Court’s majority opinion refreshingly argues that "a primary rule in interpreting a constitutional provision . . . is the rule of ‘common understanding.’" In other words, in this case the intent of the voters should be of utmost importance, as opposed to some judicially activist fabrication. The Court affirmed that the voters intended to place limits on taxes and governmental expansion.

Just what exactly distinguishes a user fee from a tax? The Court advanced three main criteria: 1) a user fee is designed to defray the costs of a regulatory activity (or government service), while a tax is designed to raise general revenue; 2) a true user fee must be proportionate to the necessary costs of the service, whereas a tax may not be; and 3) a user fee is voluntary whereas a tax is not.

The Lansing ordinance failed all three tests of a user fee. The Court determined that it constituted "an investment in infrastructure as opposed to a fee designed simply to defray the costs of a regulatory activity" and agreed with the dissenting opinion in a lower court ruling that the revenue from the charge was "clearly in excess of the direct and indirect costs of actually using the storm water system." The Lansing rain tax applied "to all property owners, rather than only to those who actually benefit," contrary to a genuine user fee.

Most plainly, the rain tax was utterly involuntary. True user fees are only compulsory for those who choose to use a service, but Lansing property owners in this case had "no choice whether to use the service" and were "unable to control the extent to which the service" was used.

The Court’s majority concluded by quoting the Headlee commission report, "This is precisely the sort of abuse from which the Headlee Amendment was intended to protect taxpayers." Amen!

The message is clear to Michigan municipalities: You now have no legitimate excuses for mislabeling taxes as "user fees." Be honest. If it’s a tax, put it before the voters as the Headlee Amendment requires, and make your best case. You can’t ignore the Constitution just because you need the money.

ISSN: 1093-2240,

SKU: V1999-13

Wednesday, January 27, 2016

Vote NO Pontiac School Millages on March 8, 2016

Hi All,

Note: there has been slight editing by me since first published 1/27/16 7:36pm/8:51pm

A non-profit organization of citizens in the Pontiac School District called Communities Acting for Responsible Education (C.A.R.E.) is seeking your support. The group was formed to promote transparency, be a watchdog, and act as both a fact finder and a source for information for residents in the district.

More information on the group can be found at carepsd.blogspot.com

or contact: Jim Endres if you would like to be involved or if you have questions.

(email: jimendres1944@hotmail.com)

Many Bloomfield Township residents who live in the Pontiac School District have been asking what is happening in the Pontiac School District (PSD.) The short answer is: nothing good. PSD continues its pattern of mismanagement and misstatements. They have again placed bond requests on the ballot on March 8, 2016. This time, they are seeking 2.87 mills from residences and 18 mills from “non-primary residence exemption” properties. You may recall that two Pontiac bond requests were denied by voters last year. These new bonds total to $586 Million. For each $35,000 of assessed value in your home, your taxes would go up by $100 per year. So, if your home has an assessed value of $100,000, your taxes will increase by $287 per year.

C.A.R.E. opposes the bond requests and seeks complete reorganization of the district because:

Please vote NO on March 8, 2016 on both bond requests.

The vote was close last time in part because the suburbs didn’t turn out to vote.

Absentee ballots are available now by contacting Bloomfield Township Clerk Jan Roncelli at 248.433.7702 .

Note: there has been slight editing by me since first published 1/27/16 7:36pm/8:51pm

A non-profit organization of citizens in the Pontiac School District called Communities Acting for Responsible Education (C.A.R.E.) is seeking your support. The group was formed to promote transparency, be a watchdog, and act as both a fact finder and a source for information for residents in the district.

More information on the group can be found at carepsd.blogspot.com

or contact: Jim Endres if you would like to be involved or if you have questions.

(email: jimendres1944@hotmail.com)

Many Bloomfield Township residents who live in the Pontiac School District have been asking what is happening in the Pontiac School District (PSD.) The short answer is: nothing good. PSD continues its pattern of mismanagement and misstatements. They have again placed bond requests on the ballot on March 8, 2016. This time, they are seeking 2.87 mills from residences and 18 mills from “non-primary residence exemption” properties. You may recall that two Pontiac bond requests were denied by voters last year. These new bonds total to $586 Million. For each $35,000 of assessed value in your home, your taxes would go up by $100 per year. So, if your home has an assessed value of $100,000, your taxes will increase by $287 per year.

C.A.R.E. opposes the bond requests and seeks complete reorganization of the district because:

- PSD consistently fails academically. According to statistics on the state’s education website, PSD is the poorest performing district in Michigan. Our high school ranks last in the state and no PSD schools are above the 8th percentile. Reports of progress in the district are pure fiction. See details on: mich.gov/mde (once there click on Student Assessment: Top-To-Bottom School Rankings)

- Enrollment has plummeted yet PSD has highest revenue per pupil. Enrollment has dropped 57% in a decade. The current drop-out rate is over 22%. Out of approximately 11,000 students who live in the district, only 4,400 attend PSD. Yet PSD has the highest total revenue per pupil among the 28 school districts in Oakland County. See details on: oakland.k12.mi.us (once there click on About Us: Publications: Summaries & Surveys)

- The Pontiac School Board is incompetent. Secret and illegal meetings, embezzlement, fraud, and misappropriation of teacher healthcare funds: that’s business as usual in PSD. Taxpayers (YOU!) were forced to pay a $7.8 million special assessment in 2013 to repay the healthcare fund. See details on: www.fbi.gov (4/17/13) and theoaklandpress.com (7/10/13)

- Poor money management put PSD in this situation. In 2013 Michigan Treasury and Oakland Schools took over PSD due to the $51.7 million deficit. After receiving $27.8 million from a special assessment and two loans, PSD now brags that the deficit is down to $33 million. Their math doesn’t add up….they actually seem to have more debt now than they did before they took out two huge loans from the state and slapped us with that special assessment in 2013. See details on: www.mackinac.org/18978 and freep.com (1/2/2016)

- PSD should have maintained and sold properties. Recently PSD sold property for about $5 million and retired a $55 million bond. A share of that money should have been used to maintain and repair facilities all along. If buildings had been sold when vacated in 2009, PSD would have realized millions and avoided expensive maintenance on empty properties. See details on: macombdaily.com (2/26/15)

- Voters rejected bonds twice last year. PSD spent $75,000 to put their proposal on the last ballot, just 3 months after another was rejected. Every dollar spent seeking these bonds comes out of your classrooms. See details on: carepsd.blogspot.com

- Please pass this information along to others you know within the Pontiac School District.

- Ask them to please vote NO on both millages.

- Voters that live in the Pontiac School District from: West Bloomfield, City of Sylvan Lake, Auburn Hills, Lake Angelus, Waterford and Orion should contact THEIR clerk for information.

Please vote NO on March 8, 2016 on both bond requests.

The vote was close last time in part because the suburbs didn’t turn out to vote.

Absentee ballots are available now by contacting Bloomfield Township Clerk Jan Roncelli at 248.433.7702 .

The Presidential Primary Election applies to all precincts.

Bloomfield Township - Local Proposals on March 8, 2016. The local proposals are only applicable to voters in voting precincts 12 & 29 who reside in the School District of the City of Pontiac. To view full text of the proposals, click here.

Subscribe to:

Comments (Atom)